Master Venture Capital

from Real-World Practitioners

Earn your certification in Venture Capital Fundamentals with HASAN.VC, a leading early-stage investor across Asia. Learn directly from active practitioners through real case studies, gain insights from a shariah-compliant perspective, and receive exclusive access to the HVC Ecosystem.

150+

Alumni Companies

Asia-Focused

Case Studies

Real-World

Market Insights

Get Certified with HASAN.VC

This certification gives you the essential tools to navigate the world of venture capital with confidence.

Learn how ethical venture capital operates, how to structure your startup for long-term resilience, and how to speak the language of global investors – all through the lens of HASAN.VC’s people-powered philosophy.

Exclusive Access

VC Fundamentals:

Graduate from the program and unlock exclusive pitch access to the HASAN.VC investment team. This is a rare opportunity to present your startup directly to senior associates inside an active early-stage VC firm.

Complete both programs and earn a limited-seat invitation to join the HVC Founders Fund Due Diligence Committee. Participate in real evaluations, observe live investment decision-making, and gain insider access typically reserved for professional investors.

For Founders:

Receive priority screening and fast-track consideration for the HVC Accelerator and HVC Venture Studio.

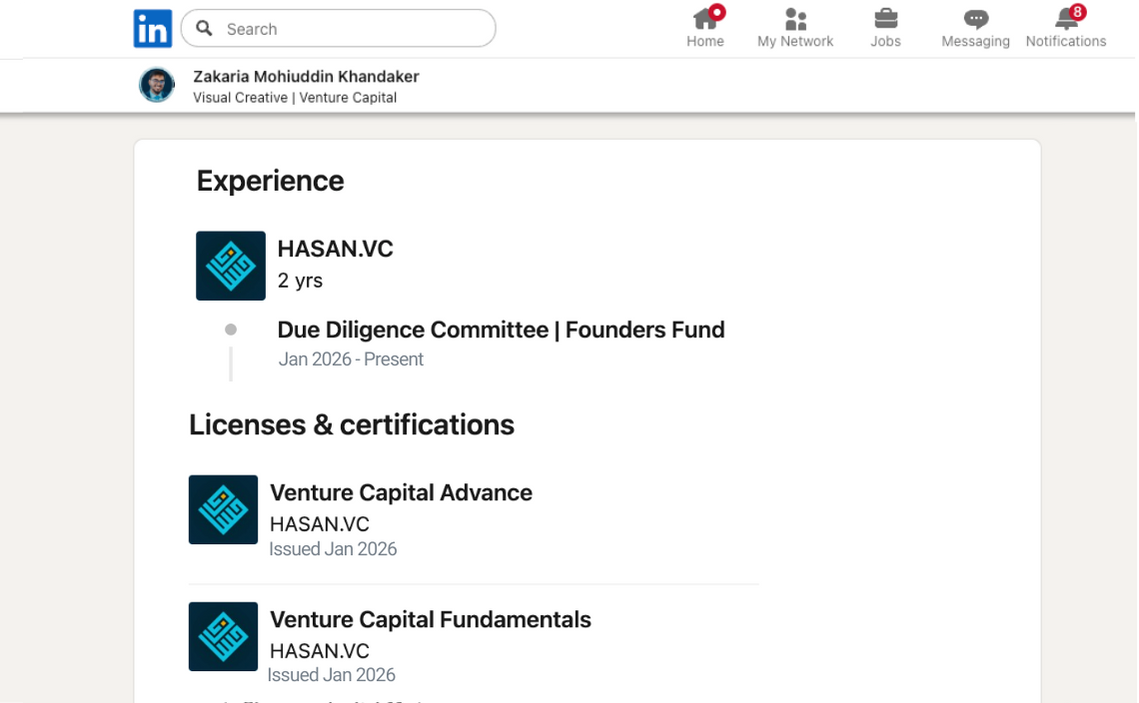

LinkedIn Badge

Complete the program and earn an officially verified HASAN.VC credential for your LinkedIn profile.

Show the industry that you understand startups the same way successful founders and active investors do. This badge tells VCs, angels, and partners that you speak the language of venture capital, and can operate at their level.

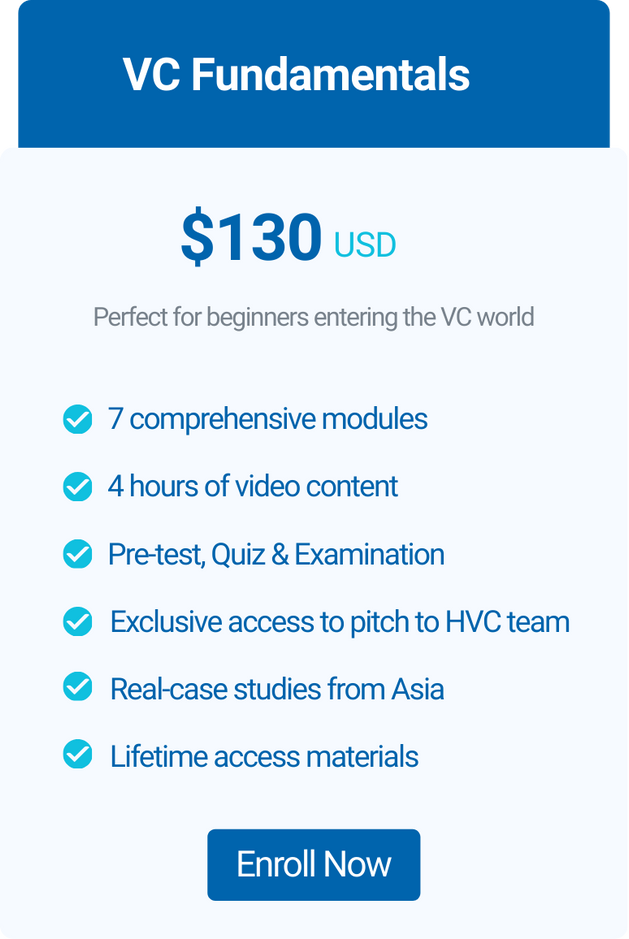

Venture Capital Fundamentals

Who is it for

Ideal for individuals who want to understand how venture capital really works and gain an early,

solid foundation in startups and their core fundamentals.

Venture Capital Advanced (Coming Soon)

Who is it for

Built for individuals who aspire to enter venture capital, invest in startups as angel investors,

or launch their own investment syndicates.

Venture Capital Fundamentals

Who is it for

Ideal for individuals who want to understand how venture capital really works and gain an early, solid foundation in startups and their core fundamentals.

Venture Capital Advanced (Coming Soon)

Who is it for

Built for individuals who aspire to enter venture capital, invest in startups as angel investors, or launch their own investment syndicates.

Meet your instructors

Mohd Akhtaar

General Partner

HASAN Venture Capital | Head of Accelerator

Industry Recognition

- Served as a judge on 8 startup panels, evaluating innovative business models and technologies.

- Winner of a prestigious New Zealand tech startup competition (1st place out of 188 entries), recognized for innovation and entrepreneurial leadership.

- Recognized as the Top Overall Performer at HASAN Venture Capital, demonstrating exceptional contributions to the firm’s success.

Key Achievements and Expertise

- Startup Training: Trained 122 startups (220+ founders) on startup fundamentals, fundraising, and scaling strategies.

- Deal Flow Expertise: Screened 890+ startups for acceptance into the Hasan VC Accelerator program, demonstrating a deep understanding of market potential and scalability.

- InDepth Due Diligence: Conducted detailed due diligence on 160+ startups for funding approval, showcasing expertise in evaluating business models, financials, and market viability.

- Investment Experience: Invested in 25 startups and served on 2 VC investment committees, providing hands-on experience in deal evaluation and portfolio management.

- Fundraising Success: Raised multiple six and seven figure rounds for startups, showcasing proven expertise in securing capital.

- Angel Network Leadership: Former Head of an Angel Syndicate with 300+ angel investors, fostering connections between startups and early stage funding.

- Incubator/Accelerator experience: Graduate of 6 prestigious accelerator and incubator programs spanning Singapore, the US, and New Zealand.

Umar Munshi

General Partner

HASAN Venture Capital

With two decades of experience as a startup founder specializing in social impact technology companies, he has developed Islamic finance platforms that have supported over 1,000 SMEs and startups. His efforts have been recognized with prestigious honors, including the Emerging Leader Award from the Royal Award for Islamic Finance, presented by the Sultan of Malaysia, and the Islamic Economy Award from the Crown Prince of Dubai.

Additionally, he is actively engaged in prominent industry committees, where he contributes to fostering positive global change through fintech innovation.

Mochamad Arifin

Senior Associate

HASAN VC Founders Fund

Arifin brings a strong background in startups, where he supported founders in raising Series A and Series B funding rounds in Indonesia’s retail and gaming sectors. Over the past four years, he has transitioned into Investment Banking and Venture Capital, with hands-on experience investing in more than 15 early-stage companies at the pre-seed and seed levels.

In addition, he manages due diligence for hundreds of startups each year. Arifin specializes in financial modeling as well as crafting compelling pitch decks and investment narratives for founders and investors.

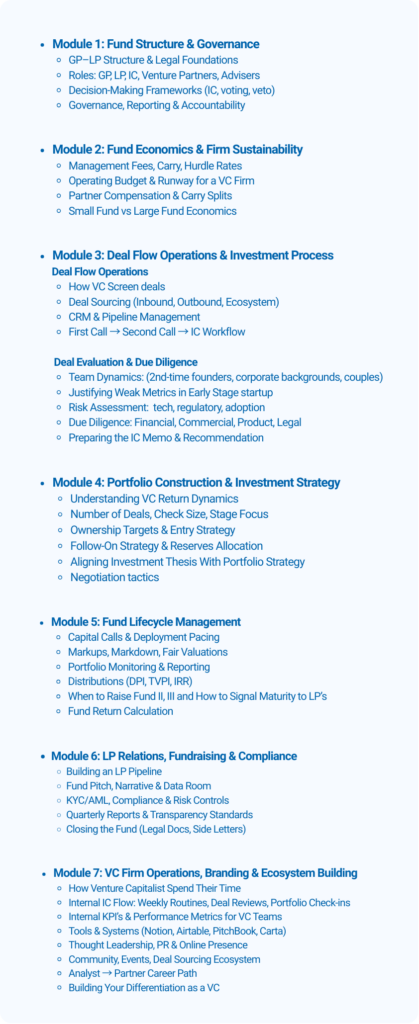

See What You Will Learn

Watch our course introduction to understand how HASAN.VC

brings real-world VC experience to your learning

Watch our course introduction to understand how HASAN.VC brings real-world VC experience to your learning

Free Resources

Download term sheet, frameworks, investment thesis and cap table template

Unlock Exclusive Access

& Real-World VC Experience

Unlock Exclusive Access & Real-World VC Experience

Complete both Venture Fundamentals and Advance to unlock a pathway normally reserved for industry insiders.

Join the Founders Fund Due Diligence Committee

- Participate in monthly startup & SME assessments, just like real VC investment teams.

- Learn how due diligence, evaluation, and investment decisions are made in the real world.

- Gain hands-on exposure by working alongside other committee members.

*Certificate submission will open when VC Advance launches in 2026

Fast-Track Into HASAN.VC Opportunities

Complete the program and earn a 1-to-1 session with an HVC Senior Associate.

Outstanding participants may be fast-tracked into the HVC Accelerator or Venture Studio, where you’ll get a chance to learn from seasoned experts in the VC ecosystem.

About Founders Fund

The Founders Fund is HASAN.VC’s curated angel syndicate:

A collaborative investment group that enables members to pool capital and invest alongside the HVC team in carefully selected early-stage startups.

While each deal typically involves a collective cheque of USD 20,000–30,000, individual participation can start from

USD 3,000, allowing investors to gain real exposure to venture investing without large minimum commitments.

Members who take part in the Due Diligence Committee have an active role in evaluating deals, contributing insights, and helping shape investment decisions, offering hands-on experience in how real venture investments are made.

FAQ: Frequently Asked Questions

What are the eligibility requirements for the HASAN.VC Venture Education program?

No prior experience in venture capital is required. The program is designed for motivated learners, aspiring investors, founders, operators, or professionals looking to understand how VC works at a practical level.

Who is the program designed for?

Ideal for emerging angel investors, syndicate leads, future fund managers, founders refining their fundraising strategy, and individuals who want to learn how venture capital truly operates from the investor and founder perspective.

Is the Venture Capital program delivered live or through recorded sessions?

The content is fully recorded, allowing you to learn at your own pace while still receiving exclusive access to community updates, live Q&A discussions, and ecosystem opportunities.

How long is the program?

You can complete the program at your own pace. Most learners finish within a few days, but you may progress faster or slower depending on your schedule.

Will all participants receive a certificate of completion?

Yes. All participants will receive a certificate of completion once they finish all modules and pass the final assessment.

Does the program include networking opportunities?

Yes. Participants gain:

Pitch access to the HVC investment team

Eligibility to join the HVC Founders Fund Due Diligence Committee

Access to the HVC Community and mailing list for ongoing opportunities

Can I continue accessing the materials after completing the program?

Absolutely. You retain ongoing access to all course materials, including future updates and newly added resources.